4xAccelerated Loan Processing

>95%Precise Credit Decision

<5 MinsAvg. customer support response time

5 DaysAvg. time-to-market

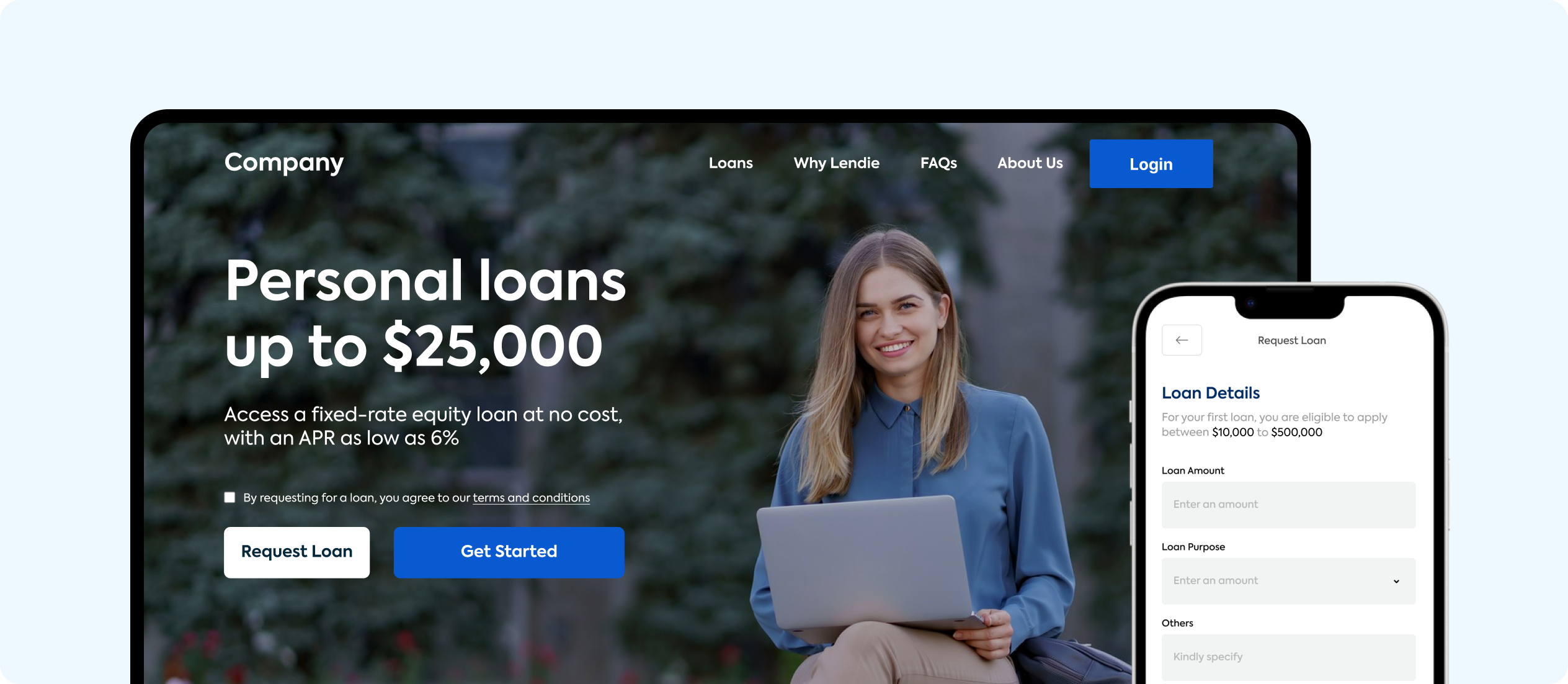

Landing Page

Integrated Application FormsStreamline data collection, identity verification, and account creation for a frictionless user journey. Simplify the onboarding process for new members by incorporating integrated application forms directly into the landing page.

Responsive DesignEnsure a seamless browsing experience across various devices with our landing page's responsive design. From desktop to mobile, your landing page will adapt beautifully to any screen size.

Custom-Tailored Unique PagePersonalize the landing page with your logo, colors, and brand messaging to create a cohesive and memorable online presence that reflects your institution's unique identity.

User-Friendly InterfaceEnsure a seamless and delightful user experience with an intuitive design. Allow your visitors to effortlessly navigate through your offerings and access real-time updates.

Discover how Configure suite can propel your institution ahead of the competition and unlock new levels of success in the industry.

The Configure suite enables Credit Unions, Fintechs, Microfinance banks, and other financial institutions to transform their operations and transition into digital banks within just 30 days.

Power to adapt the platform to meet the ever-changing demands of the market.

Disburse loans faster and improve members satisfactionUptime GuaranteeNo monthly fee if software downtime exceeds the agreed time.

Security Breach GuaranteeFee nullified for breaches caused by us.

Fast Response Time GuaranteeNo fee if we don't respond within 1 hour.

Bug-fix Time Guarantee25% discount if bugs aren't fixed within 24 hours.

Go live within 4 Weeks GuaranteeSubscription starts after successful launch.

Compliance GuaranteeOur solutions meet regulatory standards.

Explore the latest in lending innovation, cloud topics 3 Instant Loan Collection Methods to Prevent Defaults on Configure

3 Instant Loan Collection Methods to Prevent Defaults on Configure 4 Leading Strategies for a Profitable Lending Business

4 Leading Strategies for a Profitable Lending Business What is Loan Liquidation?

What is Loan Liquidation?

Loan recovery is one of the most challenging aspects of lending. Use these 3 methods to improve your loan collection strategy and ultimately reduce the impacts of outstanding loans from defaulters on your business…

Articles

February 07, 2025

Success in the lending market requires more than just offering loans—it demands proven lending strategies that propels growth.

Articles

January 31, 2025

Loan liquidation refers to the process by which a lender seeks to recover the outstanding balance of a loan when a borrower defaults. This typically involves selling the collateral (like property or vehicles) that

Articles

January 20, 2025