Every customer's lending experience is unique.Ensure speed, ease, and personalisation with your solution. Swift implementation and launchA ready-to-use consumer lending platform eliminates the need to build a lending system from scratch.

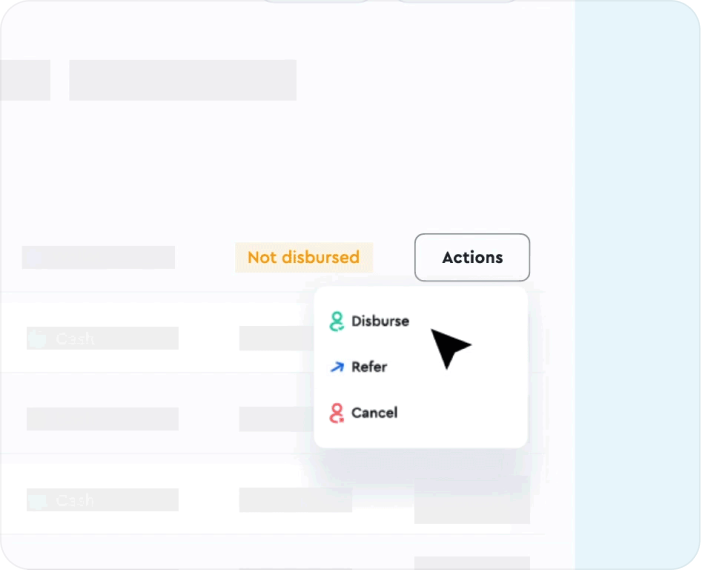

Swift implementation and launchA ready-to-use consumer lending platform eliminates the need to build a lending system from scratch. Disburse more,faster and securelyMake automated payouts and disbursements safely and quickly via local payment networks, SWIFT, or a custom channel of your choice.

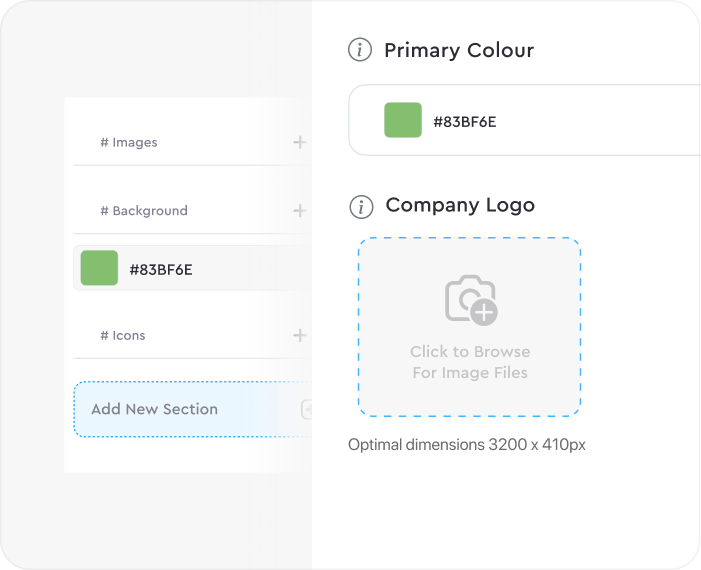

Disburse more,faster and securelyMake automated payouts and disbursements safely and quickly via local payment networks, SWIFT, or a custom channel of your choice. Intuitive Customizable InterfaceEasily navigate and access streamlined menus, clear icons, and a logical layout for a seamless experience.

Intuitive Customizable InterfaceEasily navigate and access streamlined menus, clear icons, and a logical layout for a seamless experience. Adaptable integration capabilitiesAdaptable integration capabilities for a seamless and flexible integration process with external systems, and various platforms.

Adaptable integration capabilitiesAdaptable integration capabilities for a seamless and flexible integration process with external systems, and various platforms.

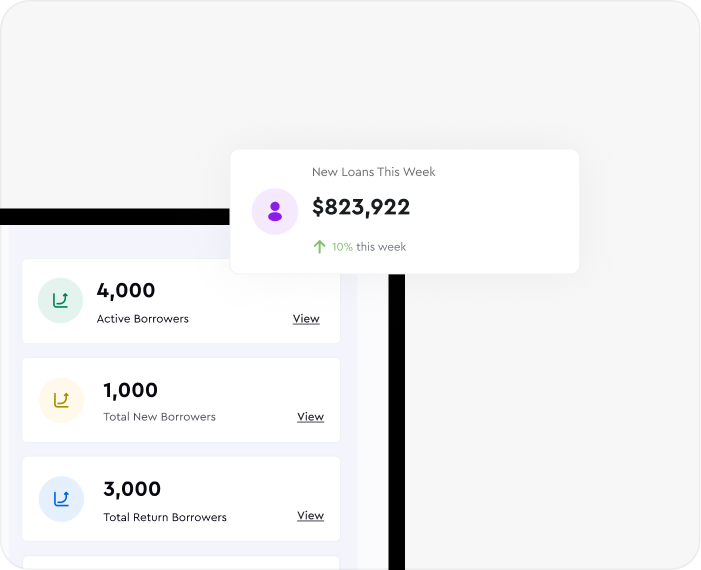

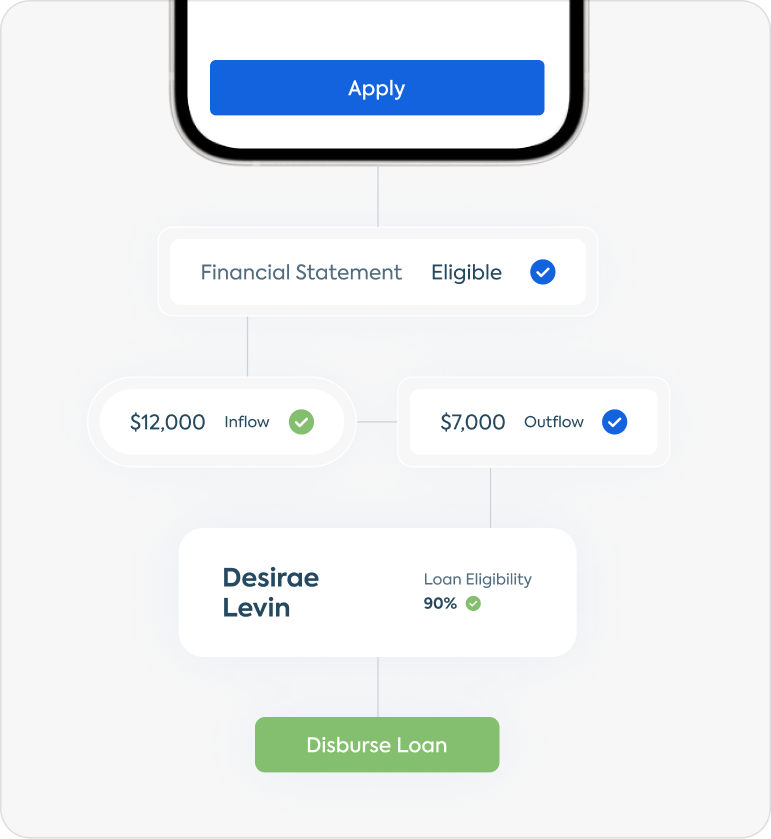

Make faster credit decisionsConfigure semi- and fully-automated lending processes, from scoring applications to product matching and approvals to make faster decisions tailored to your credit policy.

01Collect financial information securely

Collect borrower's bank statements directly from financial institutions during loan application.02Verify Identities

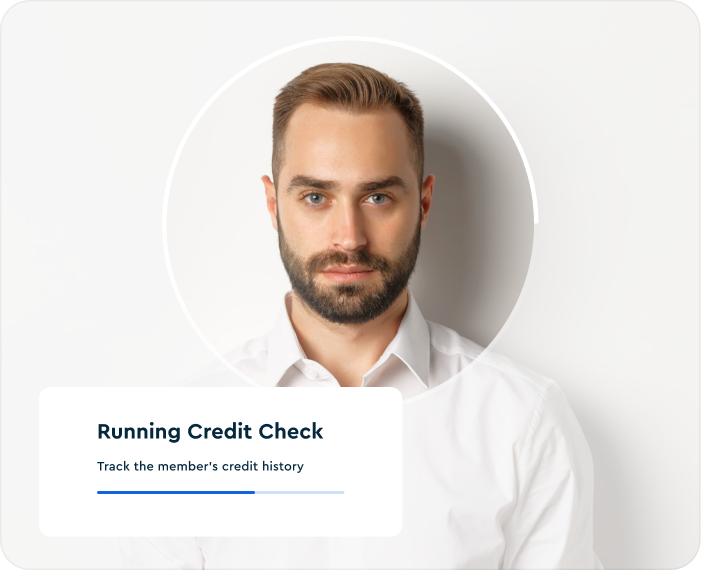

Take your KYC process to the next level. Automatically verify borrower IDs, addresses, bank accounts, and more.03Automate affordability and creditworthiness assessment

Run credit checks with a click of a button. Integrate multiple credit bureaus and alternative data sources for smarter decision making.Delight your customers with a white label mobile applicationEliminate the cost and development time associated with loan app development. Easily customize with your brand logo, colors, and themes and give borrowers an interface that has all the features of a loan app and even more.

Explore the latest in lending innovation, cloud topics

Small and medium-sized enterprises (SMEs) are undoubtedly part of the forces driving global economic growth and innovation. In the US, the commercial loan market was estimated at $2.77 trillion…

Articles

April 24, 2024

Bank statements offer a transparent view of an individual’s or business’s financial activities. Assessing a potential customer’s bank statement remains one of the most common…

Articles

April 17, 2024

Conducting creditworthiness assessments on your borrowers ensures a steady income stream in the form of interest payments and minimizes the risk of default.

Articles

April 12, 2024